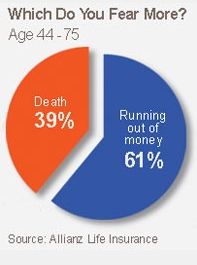

Today there is very real risk of outliving your retirement savings. Research shows that running out of retirement income is the number one fear of retiring Americans, even over death. The current probability that you will live to age 90 or 100, especially considering current medical advancements, is substantially high. Combined with the volatility of inflation and unsteady investment returns, your retirement assets can easily be diminished to nothing in a market decline.

Today there is very real risk of outliving your retirement savings. Research shows that running out of retirement income is the number one fear of retiring Americans, even over death. The current probability that you will live to age 90 or 100, especially considering current medical advancements, is substantially high. Combined with the volatility of inflation and unsteady investment returns, your retirement assets can easily be diminished to nothing in a market decline.

According to USA Today.com:

“Almost half of investors in this country are worried they will outlive their savings in retirement. In fact, 36% of retired investors and 50% of investors who aren't retired are concerned they will run out of their own money so that eventually their main source of retirement income will be Social Security”.

Furthermore, among those ages 44 to 54, 56 percent are afraid they won’t be able to cover their basic living expenses in retirement. Even more concerning, 36 percent said they had no idea whether their nest egg was sufficient. The poll also found that nearly all respondents (92 percent) agreed that the United States is facing a crisis in its retirement system. There is an apparent and logical concern among retirement-oriented investors within our country.

Increasing Numbers of Homeless Seniors

Unfortunately due to these stressful financial circumstances, our seniors are becoming homeless. According to a first-ever report by Loyola University Chicago’s Center for Urban Research and Learning, the number of homeless people over 50 is increasing at an alarming rate, leaving many with limited resources and without support.